7 Reasons Why You Should Be Saving in Gold

Gold is an investment that is expected to retain its value or even increase its value in times of market turbulence. The uncertainty of geopolitical and financial instability are the main reasons why you should hold in physical gold.

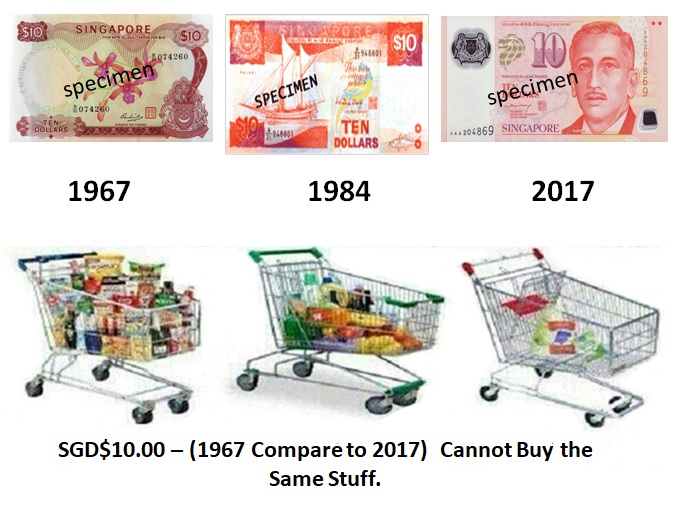

1. Gold Hedge against Inflation.

Inflation is defined as an increase in prices for goods and services in a country. Under conditions of inflation, the prices of things rise over time. Put differently, as inflation rises, every dollar you own buys a smaller percentage of a good or service.

Gold has proved itself time and again to be the perfect hedge for inflation. The real fact about Inflation weakens the Purchasing Power. The value of paper money is worth much less compared to 30 years ago. You can't even buy the same items with the same value.

2. Gold as a Safe Haven.

Gold is often called the "crisis commodity," because people feel its relative safety when world tensions rise; during such times, it often outperforms other investments. Having a Safe Haven Investment Means You Have Hard Asset

For example, gold prices experienced some major price movements this year in response to the crisis occurring in the European Union. Its price often rises the most when confidence in governments is low. Another good example of the tension between North Korea and the US Government.

3 Gold Price Rise in the Long Term.

Investing in gold may not be for everyone, but it is an appropriate consideration for many investment portfolios. Gold prices will always run into ups and downs in short and medium trading but gold is one of the safest investments in the world for long-term investment. You can observe the price of gold as of the below example, can you Guess what will be the price of 1gm Gold in 2022?

4. Gold Has its Store Value.

For thousands of years, investors have viewed gold as one of the best stores of value. Unlike paper currency or other assets, gold has maintained its value throughout the ages. The price of gold will never go Zero. Gold can be used as a long-term saving plan for your children's education, buying your dream house, saving for a dream holiday many more.

5. Gold as a Tangible Asset.

Besides lands and real estate gold is also considered a tangible asset that one must keep for long-term investment. People see gold as a way to pass on and preserve their wealth from one generation to the next. Expert has said to keep 10% of our net worth asset in physical Gold.

6. How Easy to Liquidate Gold.

Gold is an asset that can be exchanged for cash easily. If you need money you can sell your gold either at a pawn shop or sell it to a bullion store. All gold shops will accept your gold as long the gold is genuine. My advice is if you want to get a better price, sell back your gold at the same gold shop you bought it before. If you want to make a loan you also can pawn your gold at any pawnshop or Ar-Rahnu the Islamic pawnbroking.

7. Gold Cannot Be Manipulated.

Gold has to be mined. Gold cannot be printed unlike fiat money, that is why the value of money will depreciate if a country keeps printing money. Gold has endured centuries as a mark of wealth and has many benefits of gold beginning with its simplicity. It is indestructible, relatively scarce, and cannot be manufactured. Gold is one of the only assets that doesn’t carry any type of risk originating or triggered by another party’s actions or inactions. Counter-party risk doesn’t exist with gold, because you hold your physical gold.

There’s no other party involved. Nobody can do anything that’s going to impact your actual assets. You’re holding it. It can’t just go away or be stolen by hackers. However, it is important to remember that gold does not provide any income and is therefore not appropriate for investors interested in generating cash flow from their portfolios.

If you need any further assistance or have queries regarding Gold Savings and Investment. Please do not hesitate to Contact Us.

Mohd Suliman Hafid

Star Master Dealer Public Gold

Bio: https://bit.ly/MohdSuliman327

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)