What is Ar-Rahnu?

Ar Rahnu, also known as Ar Rahn, is Islamic pawnbroking for short-term collateralized borrowing. The development of Ar Rahnu provides an alternative pawnbroking service for borrowers, which is in accordance to Shari’ah principles.

Ar Rahnu is based on these Islamic concepts:

- Qardhul Hasan – The borrower is required to pay only the amount borrowed

- Ar Rahnu and Al-Wadi’ah – The borrower is required to place a valuable asset as collateral to get a loan and to ensure repayment (like a mortgage housing loan)

- Al-Ujrah – The lender is allowed to charge a fee for safekeeping of the pawned items

Mechanics of Ar Rahnu.

Ar Rahnu introduced in Malaysia was a relatively new micro credit instrument. Only gold and jewelry made of gold can be pawned. It is available to both locals and foreigners, Muslims and Non-Muslims alike, Loan tenures range from 1-6 months. Borrowers have a choice either to repay either via lump sum or by monthly installments. Generally, the margin of finance is from a minimum of RM100 up to 60-70% of the value of the gold.

In the event the borrower cannot repay the loan, it is possible to be granted extensions of up to 2 months. If the borrowers are still unable to repay the loan, the pawned item will be auctioned off and any surplus less outstanding amount and charges would be returned to the borrower.

Ar Rahnu is free from any riba and gharar element. Borrowers only need pay the principal plus a safekeeping fee as agreed in the agreement during the maturity date.

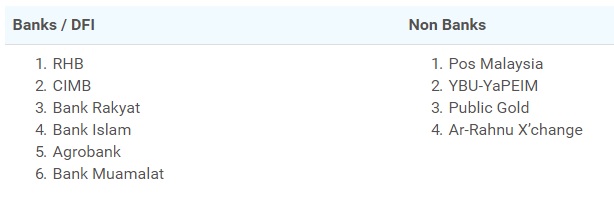

Where to get Ar Rahnu facilities in Malaysia?

In Malaysia, there are two types of agents that offer Ar Rahnu facilities:

Where to get Ar Rahnu facilities in Singapore?

If you reside in Singapore the only Ar-Rahnu with No interest (riba) involved is at Public Gold Singapore.

Below is Ar-Rahnu facilities in Singapore:

- Tampines ArRahnu: Blk 824 Tampines Street 81, #01-20 Singapore 520824

Advantages of Ar Rahnu

Compared against conventional pawn shops and unsecured personal loans, Ar Rahnu has certain advantages:

- No interest (riba) involved Interest (riba) is prohibited in Islam.Only safekeeping fees as agreed will be charged on the pledged item.

- Pawned items will be in the same condition as before When items are redeemed, there will be no problems such as shorter or lighter gold chains, which can sometimes happen with conventional pawn brokers

- Notice of Auction If the borrower is unable to repay the debt, they will be notified of the charges and about the forced sale

- Surplus will be returned If the sales price exceeds the remaining debt, the excess will be returned

- Reasonable pawn value Although the Pawnbroker Act 1972 did not fix the par value or criteria to appraise the pawned item, one can still expect a reasonable pawn value from institutionalized pawn brokers

Conclusion

Ar Rahnu is suitable to those are looking for short term loans as jewelry, gold bar or gold dinar as collateral. The process is simple and fast. Just bring the gold and you will get the loan on the same day.

If you have any query regarding Ar Rahnu Islamic Pawnbroking and interested to Invest in Gold with Shariah Compliant please do not hesitate to contact me the undersigned.

Original article from loanstreet.com.my was edited for Singapore issue.

MOHD SULIMAN HAFID - PG 027857

Master Dealer for Singapore

SMS/WhatsApp +65 9224 6333 (Spore) +6 016 6825 003 (M'sia)

Like Us at Page OneGoldDinar

I hope you will find this information is helpful and please share to fellow Singaporean who are looking for Islamic pawn broking - Ar Rahnu.